Ad Spend vs Organic Rank on the Modern Amazon Marketplace

As Lean Edge Marketing continues to coach sellers on Amazon’s newest developments, we’ve seen a massive shift in the marketplace over the last decade.

Sponsored ads are a sneaky yet aggressive addition to this mega e-commerce platform. In 2023, advertised brands and products have overtaken top organically ranked products and been heavily scattered throughout the search results page (SERPs).

A typical example of how many sponsored ads (highlighted in pink) appear on an Amazon search results page.

For desktop search results, typically only the first organic listing appears above the fold (in the last placement). Every other above the fold search result is paid placement. On mobile, you need to scroll down twice to reach the first organic search result.

Sponsored ad placements (highlighted in pink) dominate above-the-fold search results on Amazon

What may be more disappointing is that Sellers’ organic listings don’t necessarily fare better in branded search. When a buyer types a branded product name into the search bar, the first “result” may in fact be the competition or an Amazon “house” brand.

Example of how a branded search for “Serta Mattress” yields five competitor ads before Serta’s first search result.

This advertising takeover isn’t limited to search results pages. As Amazon has expanded its advertising placements throughout the marketplace, Product Detail Pages have gradually ceded valuable real estate to competitor’s advertisements.

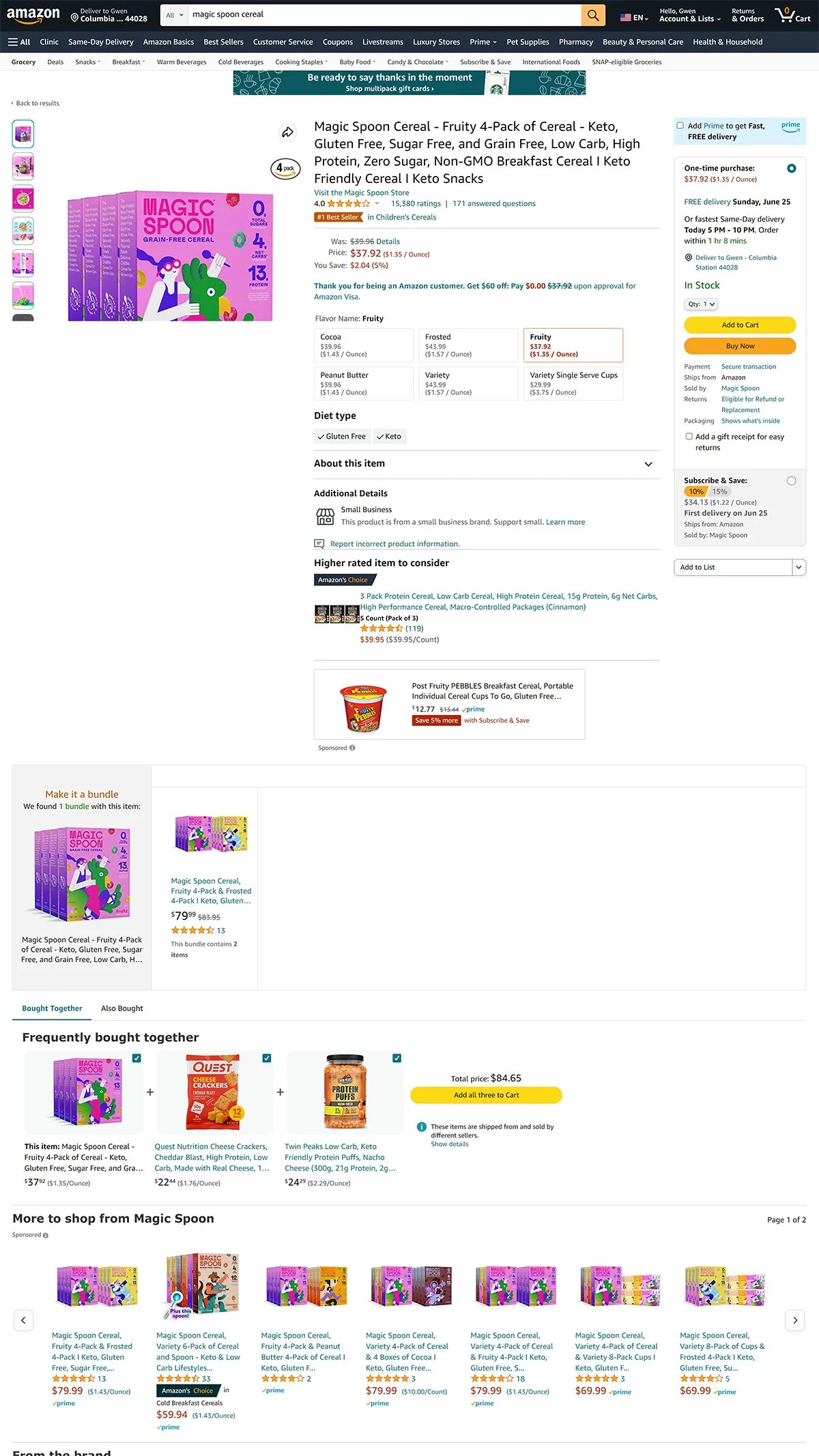

An example of the typical advertising placements on a Product Detail Page.

Given this advertising takeover, the million-dollar question is:

Are PPC ads now more important than organic rank on Amazon?

Let’s look at the facts:

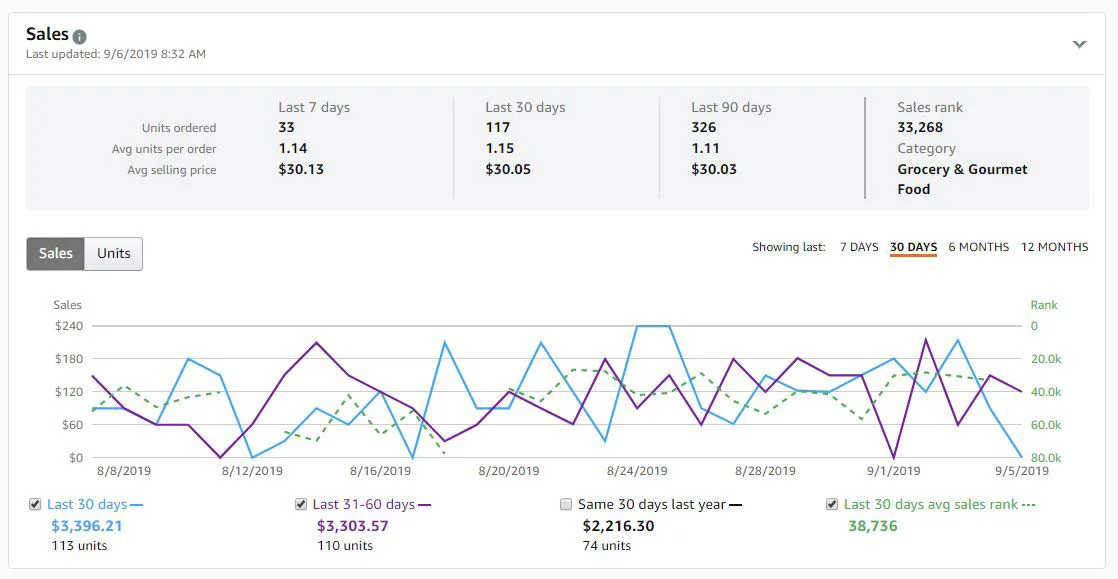

It’s true the concept of using ad space to increase brand awareness and sales is no novel strategy. What is new is the dramatic shift on Amazon, which has defined itself as a consumer-driven (not ad-driven) marketplace. Quartile announced signs of this trend way back in 2018, showing a profit margin shift for Amazon orders resulting from ads rather than organic rank.

Amazon orders generated from ads rather than organic rank -Quartile

So what does this mean for small to medium brands who sell on Amazon today - those underdogs who plunk down their precious pennies on product integrity and relevant keyword strategy? To maintain the status quo or grow sales on Amazon, they will need to embrace paid search as part of their marketing mix. While organic search is still very important and should be the source of 40-70% of your sales, paid search often yields more prominent placements. For most products and categories Amazon has become pay to play.

This may not be bad news for large brands with big budgets. Or for emerging brands that are happy to pay for early exposure and to ramp up sales. But with Amazon Seller fees and paid search costs on the rise, many smaller or more conservative brands or Sellers may be tempted to offset their increased costs by reducing their ad budgets, refocusing their channel mix or pulling their products off Amazon entirely. However, this would be generally be unwise.

If you’re a brand considering a focus on sales elsewhere. Think again.

Amazon is where the buyers are.

Amazon is Still the Largest eCommerce Platform in the United States

Amazon represents 40% of US online sales, and $2 out of every $5 spent online in the United States. Over 56% of shoppers start their product search on Amazon. In 2023, Amazon still ranks as the most trusted retailer in the United States. Amazon’s market share is so vast, that even publications, product reviewers and influencers link to product pages on Amazon. If a Seller’s or Brand’s products aren’t on Amazon, they are, by omission, significantly diminishing their ecommerce market presence.

Amazon Remains the Best Place to Spend Ad Dollars

Shinghi Detlefsen is a former Amazon employee who now runs a women’s supplement brand with a strong Amazon presence. She freely admits that it’s still more profitable to attract customers by buying ads on Amazon than Google, Facebook or her own brand’s website.

Why? Google search ads drive customers to other websites or into physical stores. Often these customers may not even be on the market to buy anything. They may just be curious or doing research. Likewise, Facebook users are focused on entertainment and communicating with friends. Even the most compelling ads might not be enough to induce Facebook users into a buying mindset. This is not true on Amazon, where there’s strong buyer intent for both browsing and targeted shopping.

While Brands and Sellers might be worried about Amazon Advertising becoming more saturated and competitive, the ROI (Return on Investment) on Amazon is often the highest, giving brands and sellers the biggest bang for their buck.

Feedadvisor’s 2022 Brands, Amazon, and the Changing Landscape of E-Marketplaces report stated that 53% of Brands advertising on Amazon see an average return of 7x’s or more. It is no surprise that the same report also states that 83% of brands are now advertising on the platform.

Additionally, any purchase made through advertising improves a product’s overall Bestsellers Rank (aka Sales Rank), improves keyword conversion rates (which boost organic visibility) and possibly creates a Repeat or Subscribe and Save Customer.

Is Advertising on Amazon Right for Every Product and Brand?

Now, you may still believe that advertising on Amazon isn’t right for you and you may be right. There are certainly unique products and categories with less competition where advertising is less necessary.

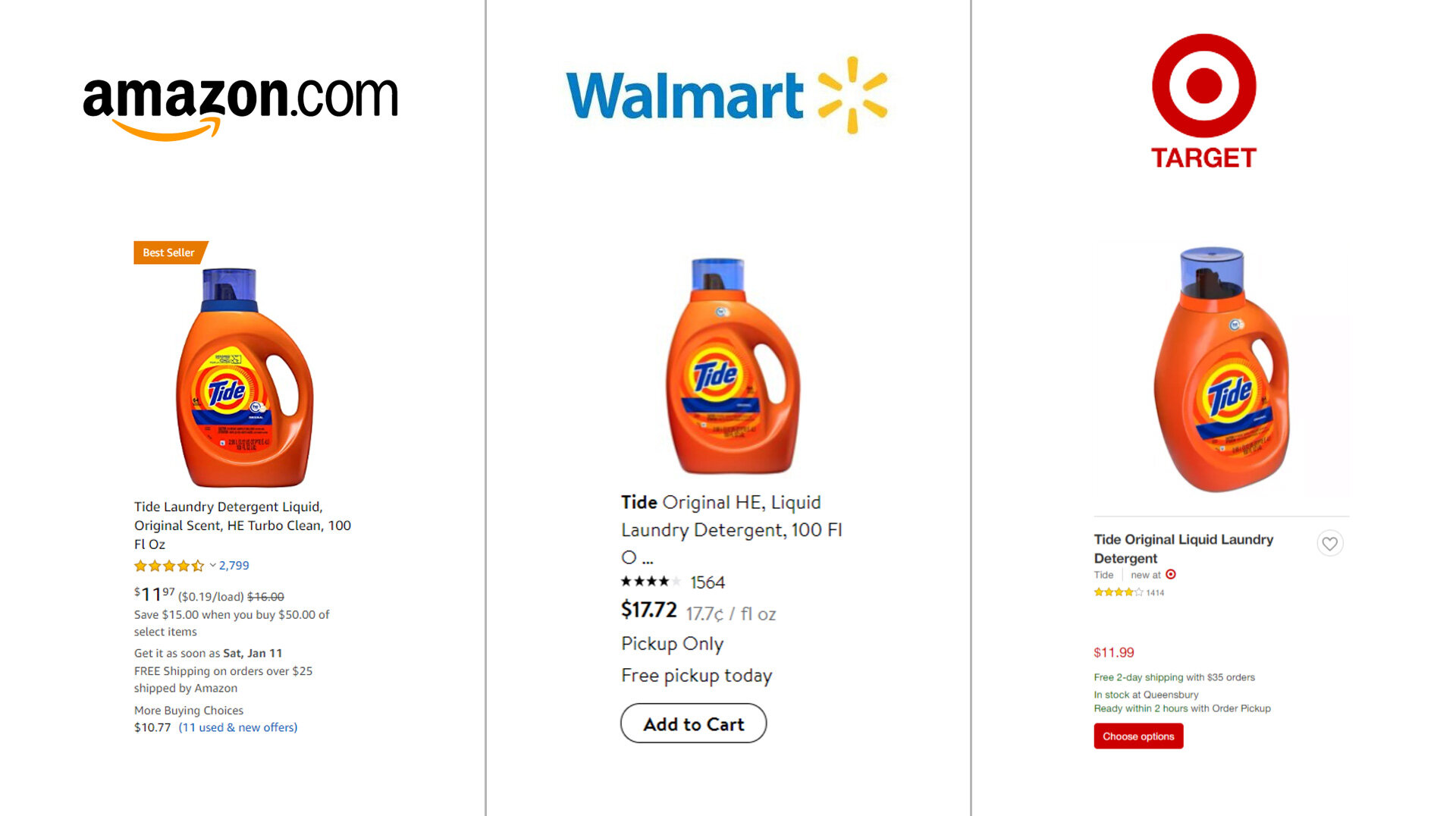

Example: TI-85 calculators have a specific consumer market looking for this exact model.

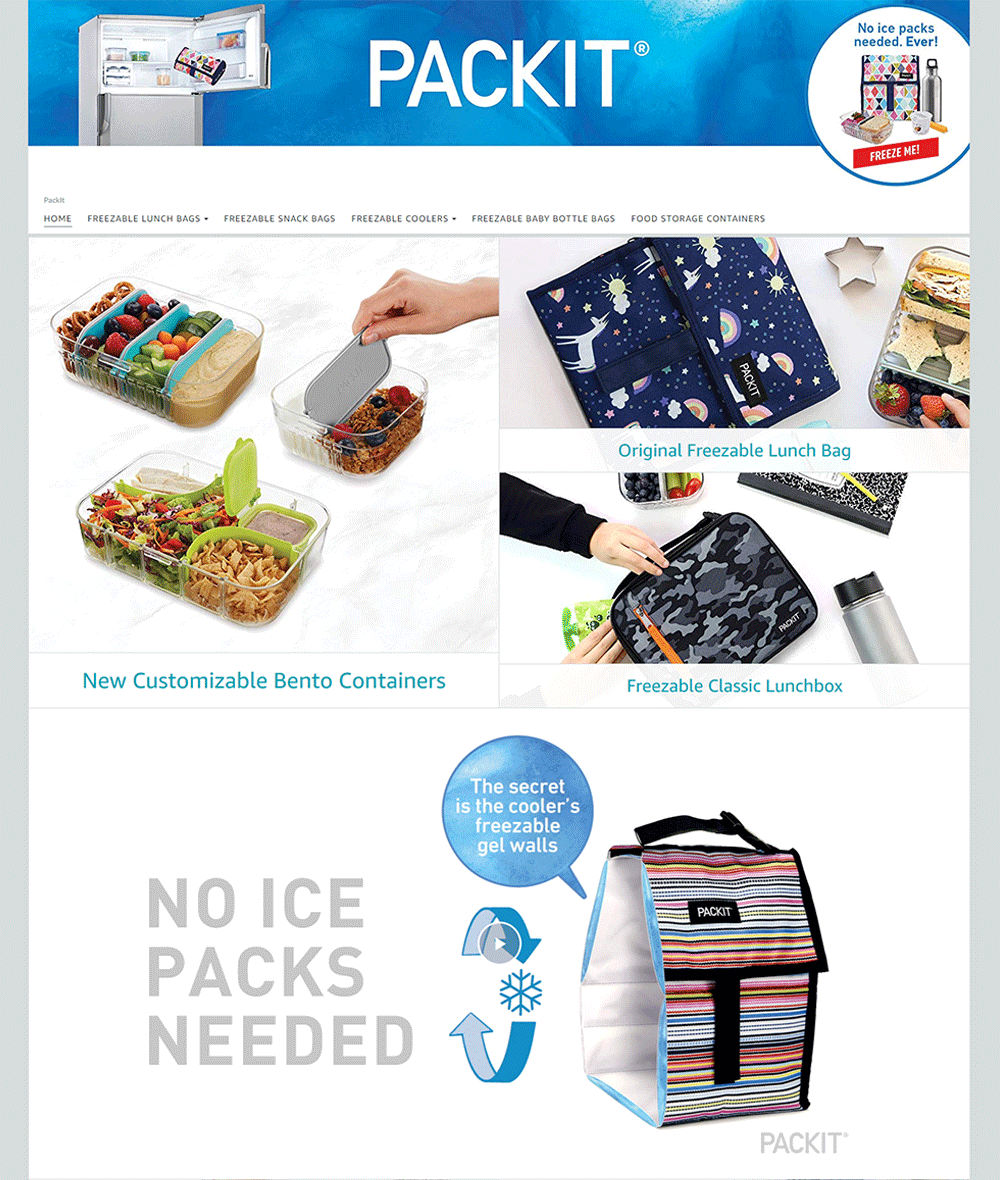

Or your product (or staff’s skills) might be ideally suited to creative gorilla marketing and offsite marketing efforts.

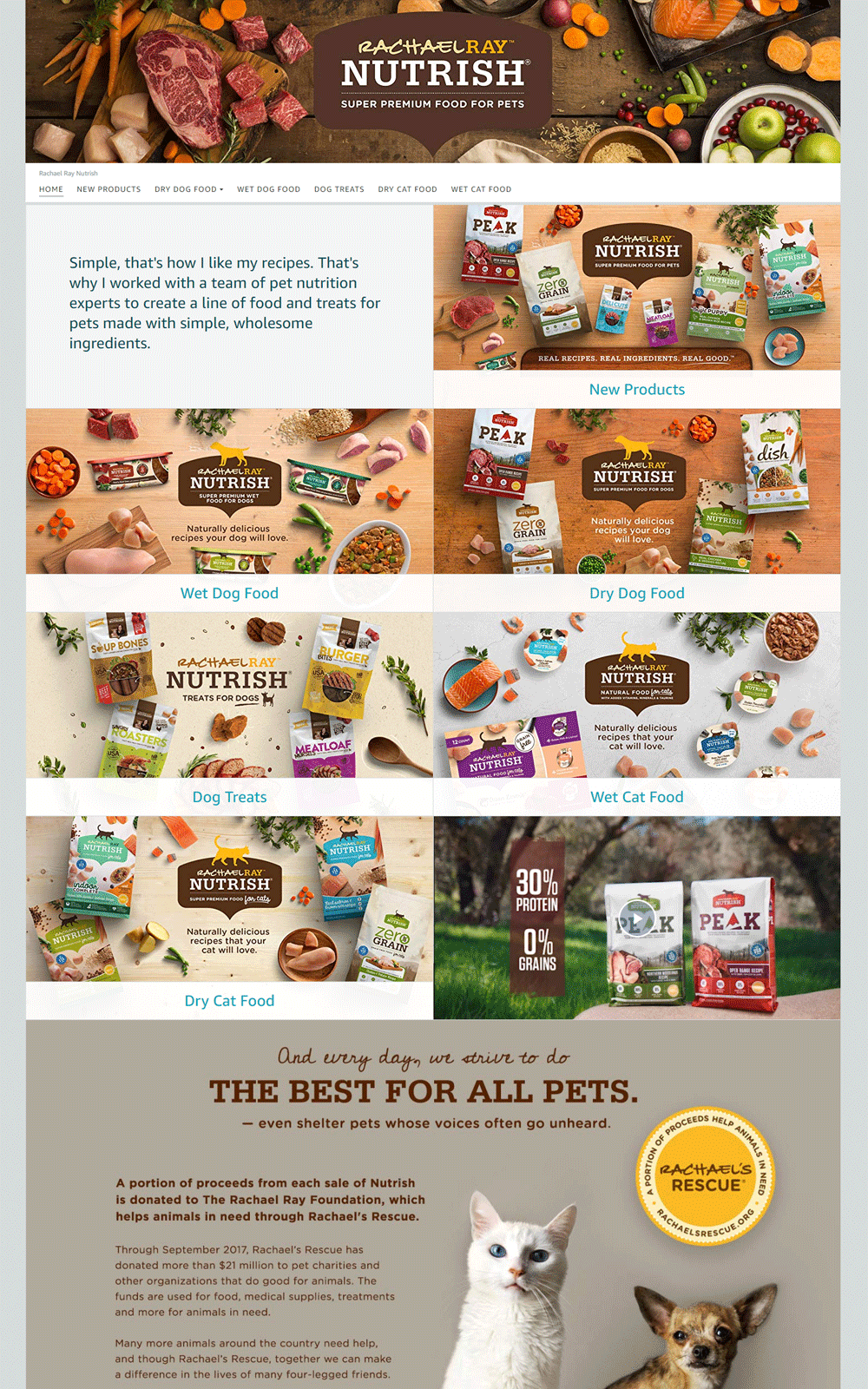

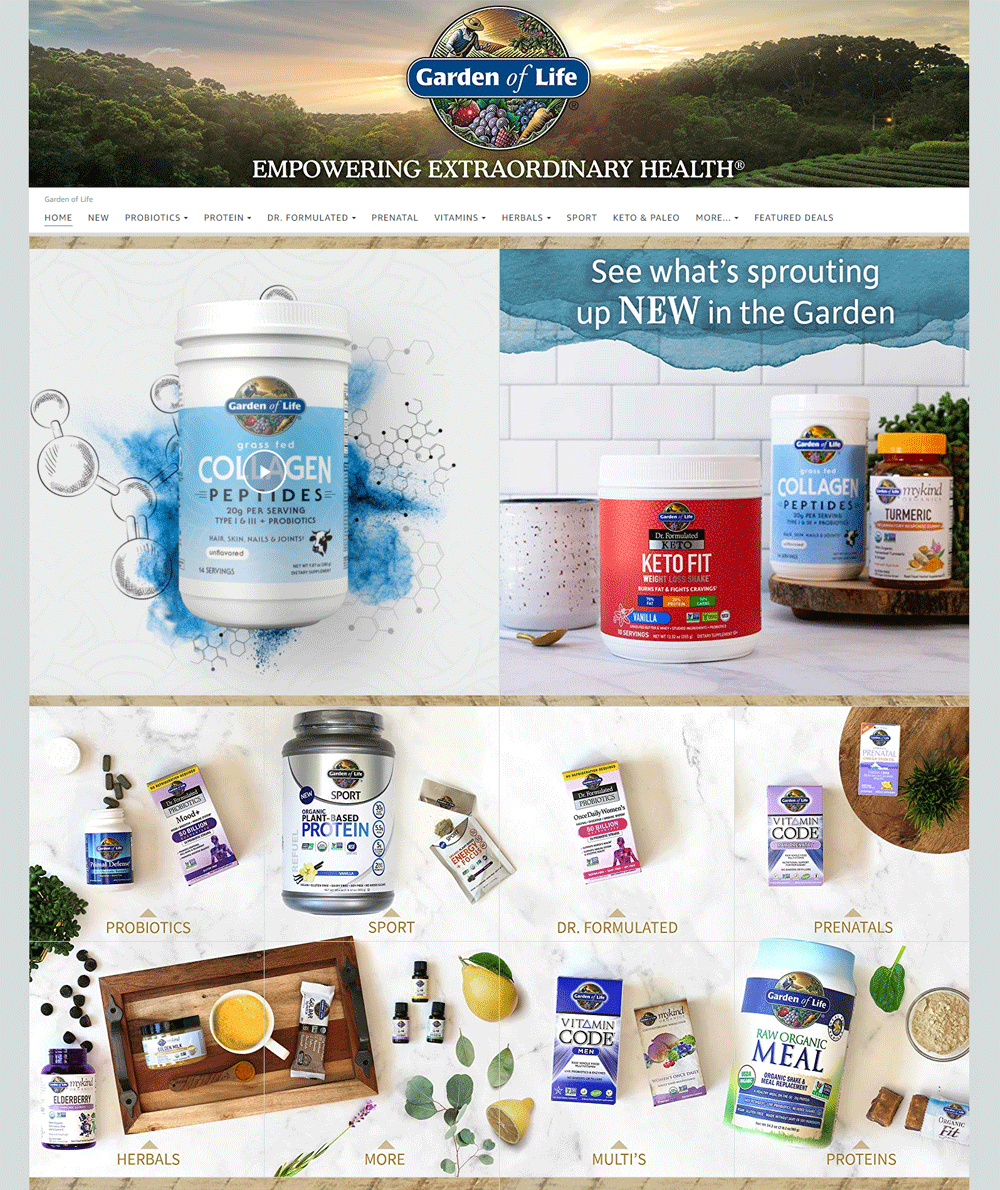

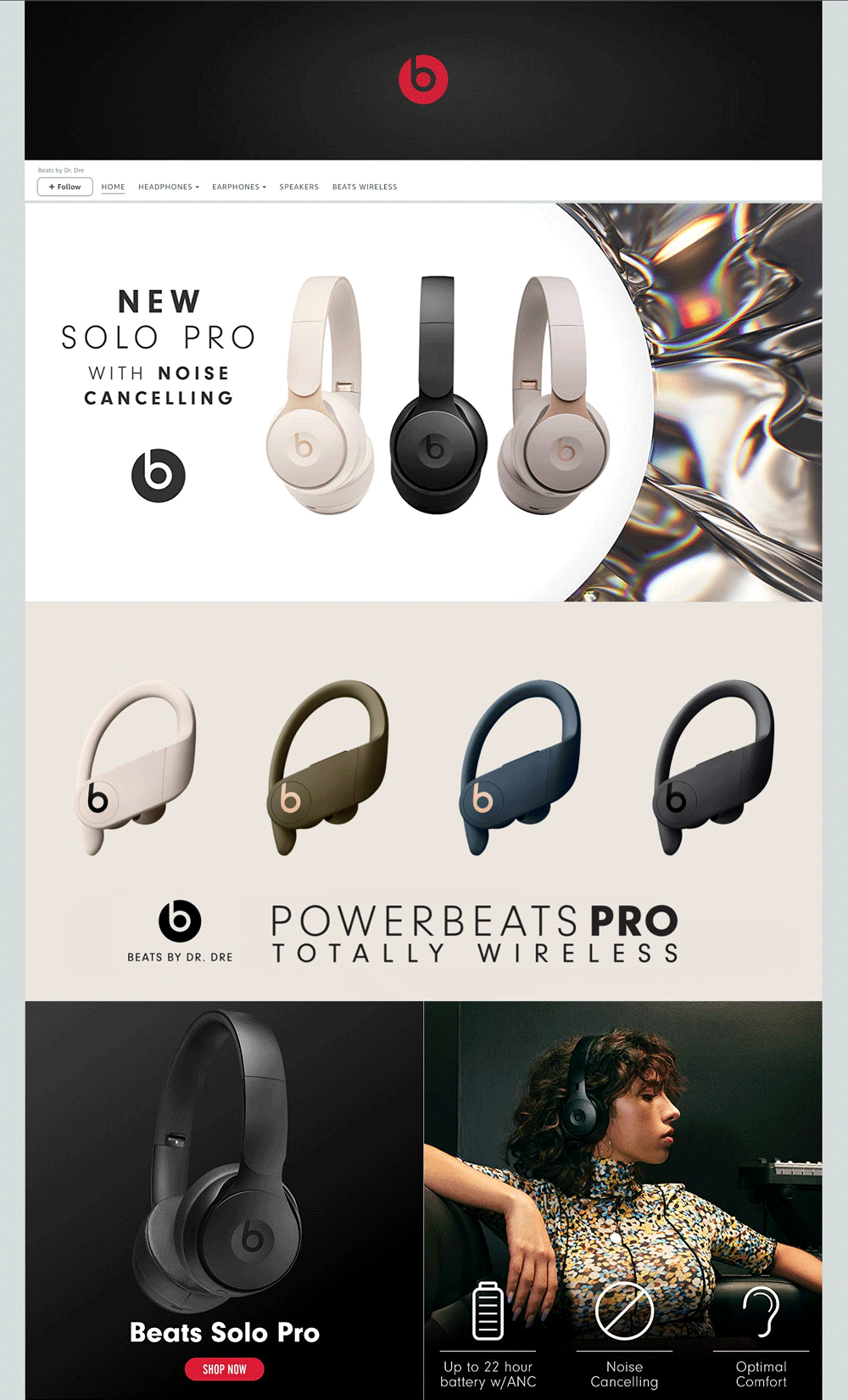

Example: Some brands experience more success using other marketing tactics.

There are also cases where you are in a heavily saturated market where there are simply too many brands competing for too few advertising terms and advertising costs reign out-of-control. If you don’t have the budgets to compete, you might want to look for alternate traffic sources. In 2022, the highest RoAS (Return on Ad Spend) was realized in the Musical Instruments category and the lowest RoAS was achieved in the Pet Supplies category.

Like any good marketer, you should evaluate your unique situation. While there are exceptions to the need for advertising on Amazon (due to talent, product, market or budget) for most Consumer Product Goods (CPGs) - advertising should be a part of their marketing mix if they want to have a healthy or growing business.

Is Advertising Necessary on Branded Search Terms?

Unless you are so comfortable with the brand loyalty of your customers that you are willing to risk competitors appearing in the first search results for Branded Search terms, it is important to use advertising as a good defensive strategy against your branded search terms. This is where share of voice (SOV) comes into play.

What is Share of Voice?

Share of voice (SOV) is a measure used to determine the percentage of the market your brand owns compared to that of your competitors. It is often used as a gauge for brand visibility, popularity and authority. SOV is most commonly referred to in reference to the brand’s share of paid advertising or traffic for certain keywords, but it can be extended to refer to total share of voice (paid + organic) for a specific product type or category.

Momentum Commerce presented research from their Data Scientist Charles May, that was gathered for the banking, aggregator and private equity sections to better understand the pervasive question “how much do we need to invest to gain additional market share?” What they discovered, is that the cost of gaining incremental market share varies on a number of factors - of which branded search volume is the most important. They found that a 1% increase in total share of voice drove an average .12% increase in the market share of the Men’s Shoes category, an average 0.325% increase in the Makeup category and an average 0.17% increase in the Laptop Computer category.

The most effective way to increase or protect your share of voice is to prevent your competitor’s from appearing in the ad slots associated with your branded search.

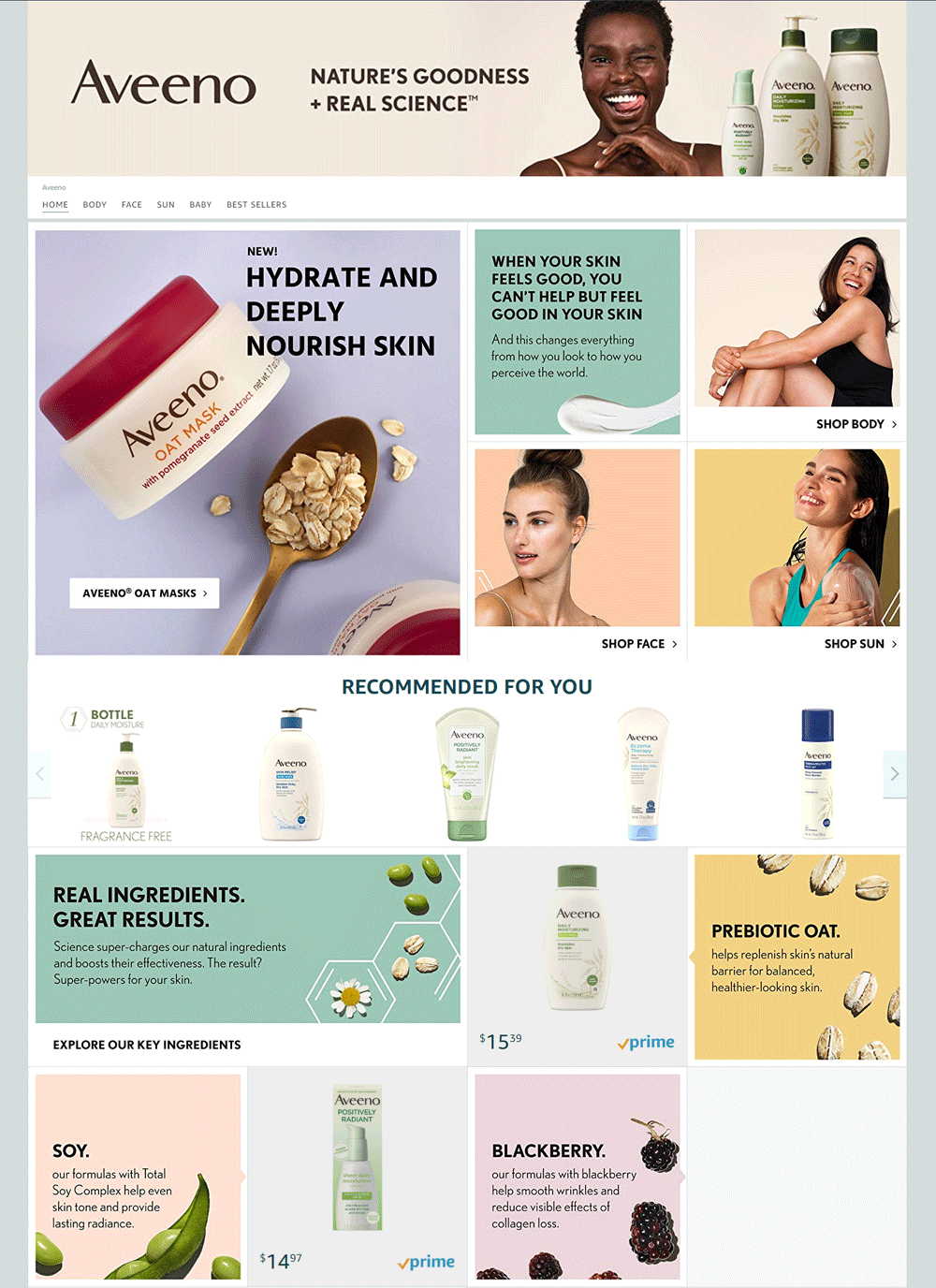

Example: Play-Doh demonstrates a high Total SOV through organic and paid branded search

This also means running a defensive ad strategy on your Product Detail Pages (PDPs). Every ad for a competitor’s product that appears on your PDP is a chance to lose a sale to a competitor. The bigger your brand impact on the potential customer, the better for closing the sale and having them associate your brand with this product category.

Example: Magic Spoon utilizes a defensive advertising strategy to protect their PDP

Inversely, if you want to increase your Share of Voice (and market share) - you can use advertising to appear on your competitor’s branded search.

Example: Hismile Toothpaste takes the top paid search placements on “Crest Toothpaste” branded search

What Is Best Practice?

Just like in a game of Monopoly, you ideally want your products to appear first and most prominently for all valuable keyword phrases and throughout your PDP pages. A strong presence in this valuable digital real estate conveys that your brand and products are the most noteworthy and creates strong brand awareness. It also helps you grow your share of voice and market share. An aggressive advertising strategy can help you achieve this.

Example: Scotch Tape appears in most of the organic and paid search results for the phrase “Tape”

If budgets don’t permit that level of aggression, you should evaluate your options, employ creativity and advertise to the level that meets your goals.

As always, Amazon Advertising alone, will not maximize your Amazon market share. You will also need to invest in great creative content, SEO and offsite marketing and advertising tactics.

In Conclusion:

If you’re a small to medium seller, it may seem discouraging that Amazon has matured into a pay-to-play platform. This change certainly benefits bigger and more well-established brands with deeper pockets.

But, for most Sellers, regardless of size, here is the silver lining:

Amazon is still the best place for you to grow your business and advertising on it continues to yield the highest ROI.

Such advertising can still improve your Bestseller Rank and organic search visibility.

More ad space means more opportunity for you to piggyback on your competition’s pages, intercepting customers and sales.

You can leverage advertising to grow your Share of Voice and market share.

Amazon’s gained ad revenue is actually financing 2 unparalleled drivers of customers to your products there—low pricing and fast shipping.

With the right know-how, you can leverage Amazon ads to mine a treasure trove of data. Telling you exactly which PPC keywords are converting sales.

Let’s focus on that last point for a moment.

There is so much data that sellers can reap from advertising campaigns on Amazon that even temporarily funded PPC campaigns can build organic rank potential in future.

Ultimately, you need to know what is right for your product and brand. Advertising is just a tool to leverage. Used wisely, and it can be advantageous to your business goals.

Unsure, what is right for you? Then seek wise counsel. Expert advertising firms know exactly how to maximize your keyword strategy and minimize the cost of your PPC ad campaigns.

Lean Edge Marketing is a Woman Owned Business Enterprise and Amazon Ads Verified Partner. Our specialty is understanding the unique paid search goals of brands like you and delivering you a competitive edge. With our personal touch and focused strategy, Lean Edge manages your bids to meet your goals. Our elite SAAS tools can help you meet your Amazon Advertising goals without wasted spend. We’re a team with decades of experience in PPC management and have managed millions of dollars of advertising spend. Let Lean Edge guide you through the complex world of modern e-commerce with Sponsored Display, Sponsored Product, Sponsored Brand, Video and DSP Advertising. We’re only a click away.